AUSTRAC is hosting its 2024 AML/CTF Advisers Forum in Melbourne and Sydney this month where discussions shed light on the regulatory priorities of Australia’s principle money laundering regulator.

Buoyed by the potential US policy shift following the Presidential election, the crypto market has rallied, meaning that increasing adoption of Digital Currency Exchanges (DCEs) and cryptocurrency flows will likely present enhanced scrutiny of AML/CTF compliance.

Recent comments from AUSTRAC highlight the critical areas of concern in this rapidly evolving space, signaling greater scrutiny and potential areas for enforcement.

AUSTRAC’s 2024 National Risk Assessment highlighted DCEs as a sector facing both heightened risks and growing regulatory attention. AUSTRAC has identified the criminal misuse of DCEs as a key concern.

criminal use of digital currency, digital currency exchanges, unregistered remitters and bullion dealers is increasing.

It is worth noting that DCE’s services for “store of value” and “conversion” are listed in the AUSTRAC report as a “medium” risk, with lawyers, companies, trusts and DCE services for “transfer of value” being rated “high” risk. Cash, property and luxury goods are rated as “very high” risk by AUSTRAC.

The report, however, makes a questionable assertion that:

Technologies that can include end-to-end encryption and digital currencies allow money launderers to hide their identities and illicit activities from law enforcement agencies.

It is well documented by crypto tracing companies that digital currencies do not allow the hiding of criminal identities and that it is in fact easier to trace and identify users of digital currencies than bank account holders or those dealing in cash. The report does go on to note:

Criminals laundering in the digital currency market use unsophisticated methods to move funds offshore quickly…Criminal groups’ persistent reliance on the traditional fiat economy means regulated on and off ramps will continue to be used to cash out of digital currency. This will allow law enforcement visibility of regulated cash-to-digital currency activity conducted through DCEs.

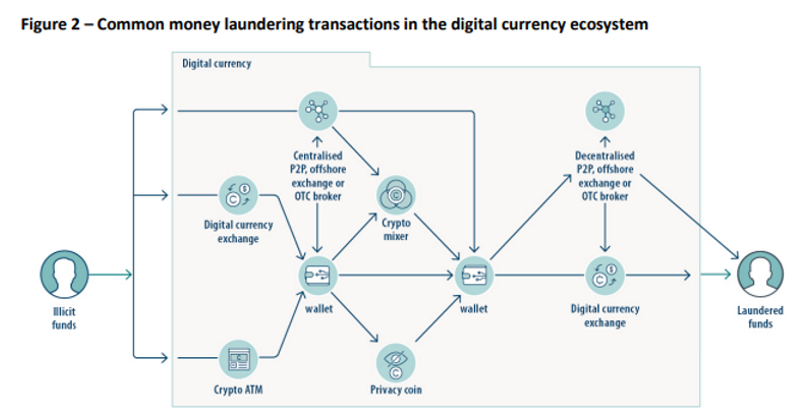

AUSTRAC highlights a common flow of illicit money laundering using digital currencies they have observed, which is worth noting would be more expensive and slower to uncover if it involved traditional bank accounts:

The assessment of increasing money laundering risk in digital assets has been reflected in AUSTRAC 2024 regulatory priorities. In recent times, sanctions compliance by DCEs has also come into increasing focus with new guidance being issued by the Australian Sanctions Office.

As a supervisory matter, AUSTRAC has strengthened its engagement with DCEs, focusing on how both on-chain and off-chain monitoring can identify suspicious activity. AUSTRAC is also seeking to understand transaction monitoring protocols within DCEs, emphasising the importance of robust, tech-enabled systems.

Another area of focus is cryptocurrency ATMs, which combine the risks associated with both cash and digital transactions. AUSTRAC is specifically wary of how these ATMs might facilitate money laundering. The UK’s recent clampdown on unlicensed crypto ATMs reflects a similar focus internationally.

AUSTRAC’s renewed attention on DCEs comes ahead of planned reforms to AML/CTF laws introduced into Parliament and expected to come into force in early 2026. These reforms will bring a number of new sectors within the AML/CTF regime while re-designating DCEs as VASPs and adding a number of new crypto related designated services. The definition of digital currency is also set to be expanded.

In that context, industry can expect an increase in regulatory scrutiny in the coming years. In the short term, the focus will be in areas like transaction monitoring and crypto ATMs, as AUSTRAC works to uphold Australia’s commitment to a transparent and secure financial ecosystem.